Quick Summary (1 Minute Read)

The Bottom Line: MLI Select's 2026 changes deliver massive premium discounts: up to 30%: through a simplified point system. BC developers can save $200,000+ on larger projects by strategically targeting energy efficiency, affordability, and accessibility commitments during the September 30, 2026 transition period.

Key Dates: November 28, 2025 changes are live, with a transition window until September 30, 2026 for energy standards.

Biggest Win: Projects achieving 100+ points unlock 30% premium discounts AND 50-year amortizations, dramatically reducing both insurance costs and monthly debt service.

The New MLI Select Discount Structure (Game Changer)

Gone are the complex minimum requirements that trapped developers in rigid commitments. The 2026 MLI Select program operates on pure flexibility: you choose your commitment level and earn proportional discounts.

Here's the new discount schedule that's saving BC developers serious money:

- 50+ Points = 10% Premium Discount

- 70+ Points = 20% Premium Discount

- 100+ Points = 30% Premium Discount

"The removal of minimum requirements changes everything," explains Varun Chaudhry, Financial Advisor at Kraft Mortgages Canada Inc. "Developers can now strategically pick their battles: focus on energy efficiency if that's your strength, or prioritize affordable units if land costs are favorable. You're no longer forced into a one-size-fits-all approach."

Real Numbers: Surrey 24-Unit Development Example

Let's break down the actual savings on a typical Metro Vancouver project: a $5 million, 24-unit rental building in Surrey.

Traditional MLI Standard Premium: 3.35%

Cost: $167,500

MLI Select with 70+ Points (20% discount): 2.68%

Cost: $134,000

Immediate Savings: $33,500

MLI Select with 100+ Points (30% discount): 2.35%

Cost: $117,500

Immediate Savings: $50,000

But here's where the real magic happens: extended amortization periods:

- 70+ points unlock 45-year amortizations

- 100+ points unlock 50-year amortizations

On our Surrey example, extending from 25 to 45 years reduces monthly debt service by approximately $8,200. That's $98,400 annually in improved cash flow.

The September 2026 Energy Efficiency Window

Here's your strategic advantage: Until September 30, 2026, projects can qualify under either the previous energy standards OR the new 2020 NECB and 2020 NBC criteria.

This transition period creates a unique opportunity for BC developers:

Option 1: Fast-track projects using familiar energy standards you've already mastered

Option 2: Invest in upgraded energy efficiency for higher point totals and bigger discounts

"Smart developers are running dual scenarios right now," notes Chaudhry. "We're seeing projects that can hit 70+ points under the old standards, but might stretch to 100+ points with strategic energy upgrades. The mortgage affordability calculator BC numbers don't lie: sometimes that extra 10% discount justifies significant energy investments."

Where the Biggest Savings Hide

MLI Select discounts become exponentially more valuable on specific project types:

Construction Loans

Construction financing typically carries higher premiums due to risk factors. The 30% MLI Select discount applies AFTER these surcharges, making the absolute dollar savings massive.

Higher-LTV Projects (85%+)

Projects with limited equity see premium surcharges that can push base rates to 6-7%. A 30% discount on these elevated premiums delivers outsized returns.

Specialized Housing (Student, Seniors, Supportive)

These projects often face additional premium layers. MLI Select's percentage-based discounts stack powerfully on top of specialized housing surcharges.

Strategic Point Optimization for BC Markets

The MLI Select point system rewards three core areas:

Affordability (Up to 50 Points)

- Below-market rental commitments

- Rent-geared-to-income units

- Affordable homeownership components

BC Advantage: Metro Vancouver's rent control environment makes affordable commitments more predictable than in other markets.

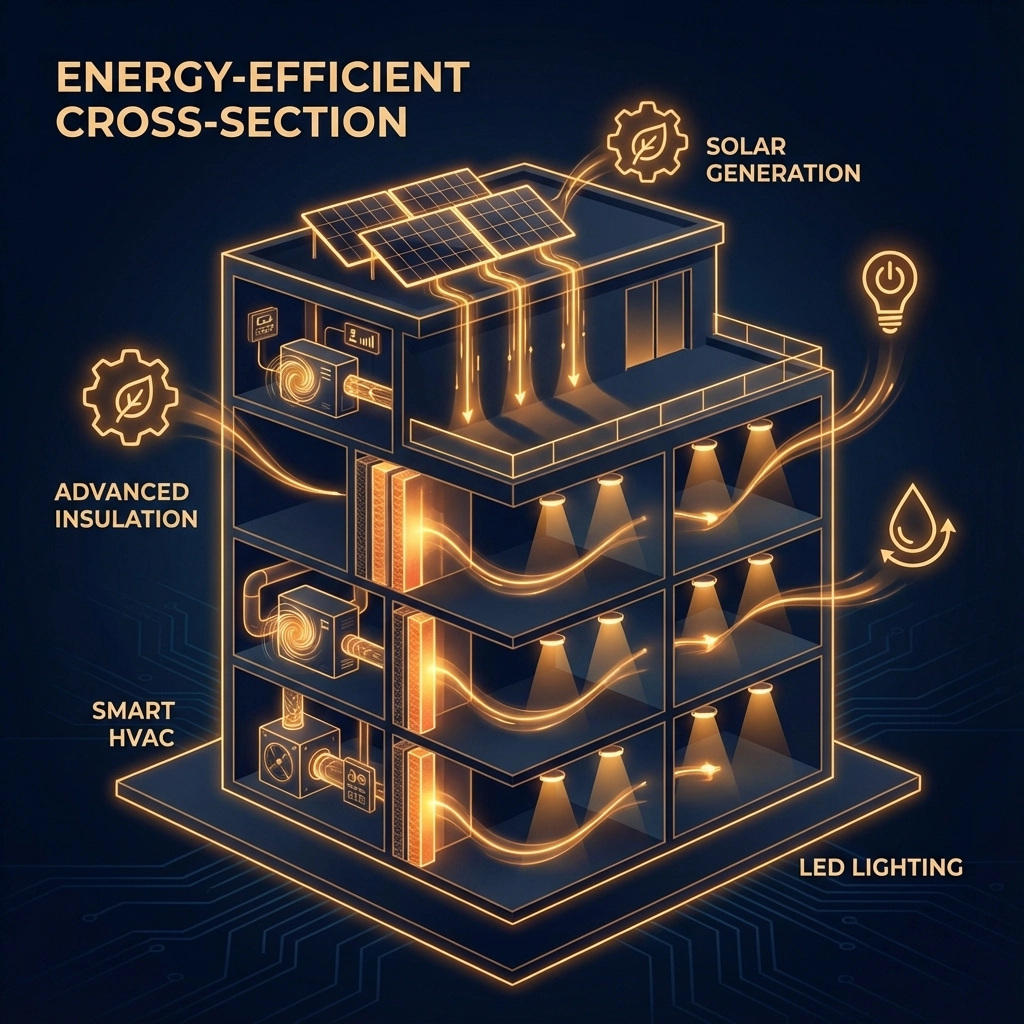

Energy Efficiency (Up to 50 Points)

- 2020 NECB compliance (new standard)

- Advanced building envelope performance

- Renewable energy integration

BC Advantage: BC Hydro rebates and CleanBC incentives can offset energy upgrade costs, making higher point targets financially viable.

Accessibility (Up to 50 Points)

- Universal design features

- Above-code accessibility standards

- Barrier-free unit percentages

Why Your Edmonton Mortgage Broker Might Miss This

MLI Select optimization requires intimate knowledge of both CMHC's evolving criteria AND local market dynamics. A mortgage broker in Alberta or Edmonton mortgage broker might understand the program mechanics, but miss BC-specific opportunities:

- BC Hydro's Step Code requirements that overlap with MLI Select energy points

- Metro Vancouver's rental market conditions that make certain affordable commitments viable

- Provincial accessibility standards that exceed federal minimums

"We're seeing out-of-province brokers recommend safe 50-point strategies when their BC clients could easily hit 70+ points with local knowledge," explains Chaudhry. "That's leaving $20,000-$50,000 on the table for mid-sized projects."

The Appraisal Enhancement Factor

Recent MLI Select changes include enhanced appraisal requirements that actually benefit prepared developers. CMHC now requires detailed documentation of MLI Select commitments during the appraisal process.

This creates competitive advantages for developers who:

- Document their MLI Select strategy early in project planning

- Work with mortgage broker Surrey professionals who understand the appraisal requirements

- Build relationships with appraisers familiar with MLI Select valuations

Timing Your MLI Select Application

The optimal application timing depends on your project's complexity and point strategy:

50-Point Strategy (10% Discount): Can often be confirmed at preliminary approval stage with basic commitments

70-Point Strategy (20% Discount): Requires more detailed planning but offers substantial savings on projects over $3 million

100-Point Strategy (30% Discount): Demands comprehensive early-stage planning but unlocks maximum savings plus 50-year amortizations

"The biggest mistake we see is developers treating MLI Select as an afterthought," warns Chaudhry. "The point optimization needs to start during land acquisition. Your mortgage broker Surrey team should be running MLI Select scenarios before you finalize your development pro forma."

Looking Beyond 2026

CMHC continues evolving MLI Select to support federal housing targets. Early indicators suggest future enhancements could include:

- Additional points for climate resilience features

- Expanded affordability definitions aligned with local market conditions

- Technology integration points for smart building features

Developers establishing MLI Select expertise now position themselves for ongoing advantages as the program expands.

Next Steps for BC Developers

The September 30, 2026 transition deadline creates urgency for projects in pre-development phases. Your immediate action items:

- Run MLI Select scenarios on current projects using both old and new energy standards

- Evaluate point optimization strategies that align with your development strengths

- Connect with specialized financing advisors who understand MLI Select mechanics and BC market conditions

The potential savings: $200,000+ on larger projects: justify significant upfront planning investment.

Ready to optimize your MLI Select strategy and unlock maximum savings? Contact Kraft Mortgages Canada Inc. to schedule a discovery call with Varun Chaudhry and explore how the 2026 MLI Select changes can transform your project economics.

Your development's success depends on accessing every available advantage; and MLI Select's enhanced discount structure delivers exactly that opportunity.

Leave a Reply