3-minute read | Updated: January 26, 2026

A 100% tariff on every Canadian product entering the United States. That's not a typo. That's the threat President Donald Trump issued this weekend, and if you're a Canadian homeowner with a mortgage renewal coming up in 2026, this political standoff could hit your wallet harder than you think.

Here's what's happening, why it matters to your mortgage rate, and what smart homeowners are doing right now.

The Standoff: Trump vs. Carney (Jan 24-26, 2026)

The tension escalated rapidly over the past 72 hours. President Trump announced that Canada would face a 100% tariff on all goods exported to the United States if Prime Minister Mark Carney pursues any trade arrangement involving China.

The trigger? Canada recently negotiated a deal allowing 49,000 Chinese electric vehicles into the Canadian market at a 6.1% tariff rate, in exchange for Beijing lowering tariffs on Canadian canola. Trump called it unacceptable, warning that Canada should not become a "drop-off port" for Chinese goods destined for American consumers.

Prime Minister Carney isn't backing down. His government insists this was a targeted tariff resolution: not a free trade deal with China. Trade Minister Dominic LeBlanc clarified that "there is no pursuit of a free trade deal with China."

But the damage may already be done. Markets are watching. Currency traders are reacting. And the ripple effects are heading straight toward your mortgage payment.

Why This Matters to Your Mortgage: The Currency Connection

Here's the economics lesson most Canadians never learned: when trade wars escalate, the Canadian dollar takes the hit.

A 100% tariff on Canadian exports to the U.S. would be catastrophic for our economy. The United States buys approximately 75% of Canada's total exports. If American buyers suddenly face double the price on Canadian goods, demand collapses. Canadian businesses lose revenue. Jobs disappear. The economy contracts.

When investors see this risk, they sell Canadian dollars. The Loonie drops.

Why does a weaker Loonie affect your mortgage?

Because Canada imports a significant portion of its goods: everything from electronics to food to building materials. When our dollar weakens, imports become more expensive. That's inflation.

And inflation is the Bank of Canada's worst enemy.

The Bank of Canada's Impossible Choice

Governor Tiff Macklem and the Bank of Canada were on a promising path. After aggressive rate hikes in 2022-2023 to tame inflation, they began cutting rates in 2024. Many homeowners breathed a sigh of relief, anticipating lower mortgage costs heading into 2026.

That trajectory just got complicated.

If the Trump tariff threat materializes: or even if it simply lingers as a credible threat: the Bank of Canada faces a brutal dilemma:

-

Cut rates to stimulate the economy and help businesses survive the trade war, but risk fueling inflation from a weaker dollar and higher import costs.

-

Hold rates steady or hike them to protect the dollar and fight inflation, but crush an already struggling economy.

Neither option is good for homeowners.

If the Bank pauses rate cuts, those variable-rate mortgage holders waiting for relief won't get it. If they're forced to hike rates to defend the Loonie, payments go up.

The bottom line: The rate cuts you were counting on for your 2026 renewal may not arrive. In a worst-case scenario, rates could actually climb.

The 2026 Renewal Crisis Just Got Worse

You've probably heard the term "mortgage renewal wall." It refers to the massive wave of Canadian homeowners whose mortgages: locked in at historically low rates during 2020-2021: are coming up for renewal in 2025 and 2026.

The numbers are staggering:

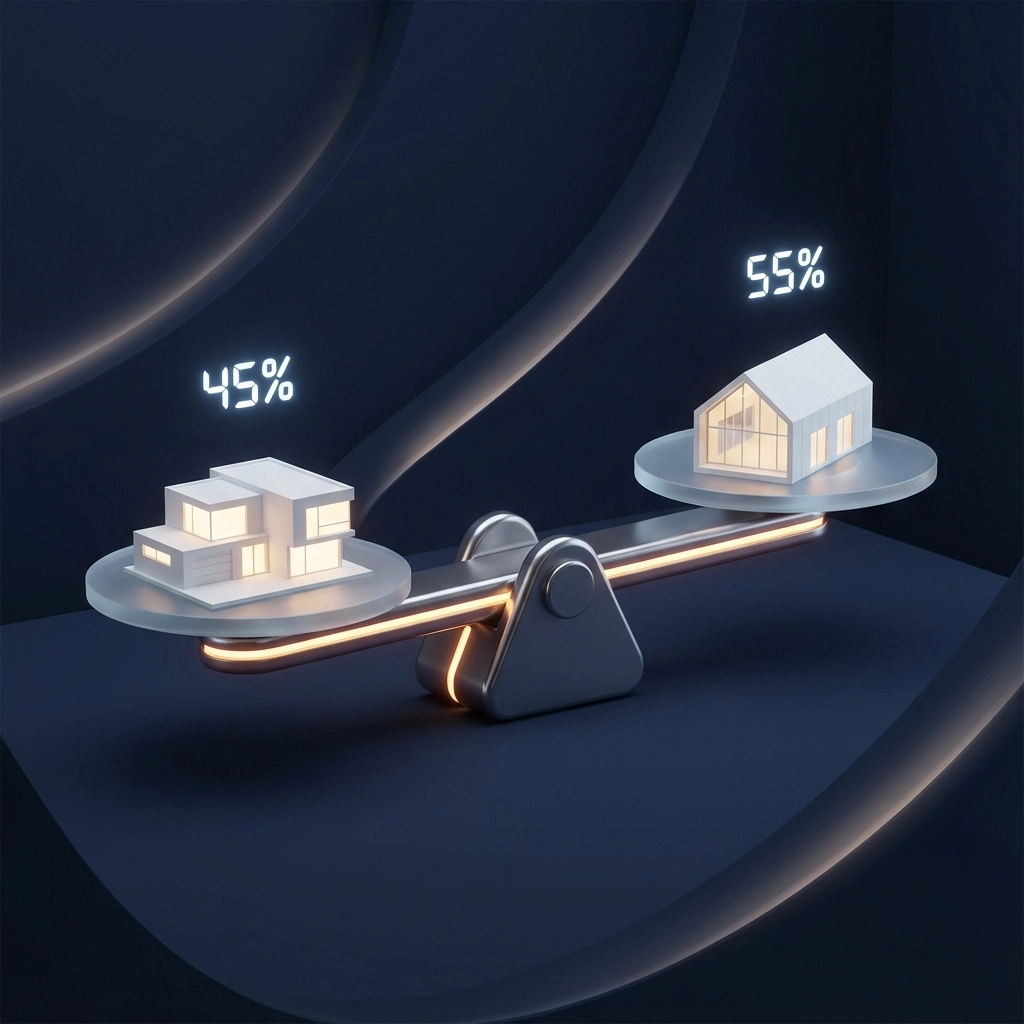

- Approximately 1.2 million mortgages are set to renew in 2026

- Many of these homeowners locked in at rates between 1.5% and 2.5%

- Current rates hover between 4.5% and 5.5%

That's a payment shock of $400 to $800 per month for many families.

The hope was that continued Bank of Canada rate cuts would soften the blow. The Trump tariff threat puts that hope in jeopardy.

If you're renewing in 2026, you need to understand: the geopolitical landscape is now a direct factor in your household budget.

What Smart Homeowners Are Doing Right Now

Here's what we're telling our clients at Kraft Mortgages:

1. Lock In Early If Your Renewal Is Within 120 Days

Most lenders allow you to lock in a rate up to 120 days before your renewal date. If you're within that window, don't wait. The rate environment could shift dramatically in Q1 2026.

Use our mortgage calculator to model different rate scenarios and see the impact on your payment.

2. Stress-Test Your Budget at Higher Rates

Hope for the best, plan for the worst. Run your numbers assuming rates stay flat or increase by 0.25% to 0.50%. Can your household absorb that?

Our affordability calculator helps you see exactly where your limits are.

3. Consider Refinancing Now

If you have equity in your home and your current rate is competitive, refinancing now: before any potential rate increases: could save you thousands over your next term.

Explore your options with our refinance calculator.

4. Avoid the "Wait and See" Trap

The worst decision right now is no decision. Many homeowners assume that trade disputes resolve quickly or that markets always stabilize. Sometimes they do. Sometimes they don't.

The 2018 NAFTA renegotiations dragged on for over a year. The 2020 pandemic market chaos lasted 18 months. Geopolitical uncertainty can persist far longer than your budget can tolerate.

The Bigger Picture: Tariffs Are Mortgage Policy Now

This might feel strange. You're a homeowner in Vancouver, Calgary, or Toronto. What does a trade war with the United States have to do with your monthly payment?

Everything.

Modern mortgage rates aren't set in a vacuum. They're influenced by:

- Bank of Canada policy decisions

- Bond yields (which respond to global risk sentiment)

- Currency fluctuations

- Inflation expectations

- Geopolitical stability

When the President of the United States threatens to impose 100% tariffs on your country's exports, every single one of those factors moves.

This is the new reality of mortgage planning. It's not just about your income, your credit score, and your down payment anymore. It's about global trade, currency markets, and political brinksmanship.

What Happens Next?

The next 30 days are critical. Watch for:

- Bank of Canada's next rate announcement (and any language about trade uncertainty)

- Further escalation or de-escalation between Trump and Carney

- Canadian dollar movements against the USD

- Bond yield trends (which directly influence fixed mortgage rates)

We'll be monitoring all of these factors and updating our clients in real-time.

Don't Navigate This Alone

If your mortgage renewal is coming up in 2026: or if you're considering a purchase or refinance: you need a strategy that accounts for this volatility.

At Kraft Mortgages Canada Inc., we specialize in helping clients navigate complex market conditions. We're not just rate shoppers. We're strategic advisors who understand how macroeconomic forces translate into your monthly payment.

Contact us today to review your options before the market shifts again.

Kraft Mortgages Canada Inc. serves clients across British Columbia, Alberta, and Ontario. We specialize in complex mortgage solutions, refinancing strategies, and helping families protect their financial future( even when global politics makes headlines.)